On Monday, October 27, 2025, WiseTech Global, one of Australia’s leading logistics software companies, faced a significant regulatory investigation as the Australian Federal Police (AFP) and the Australian Securities and Investments Commission (ASIC) executed a raid on its Sydney headquarters. The action centers around alleged improper share trading activities involving the company’s co-founder and executive chairman, Richard White, along with three employees.

Background of the Investigation

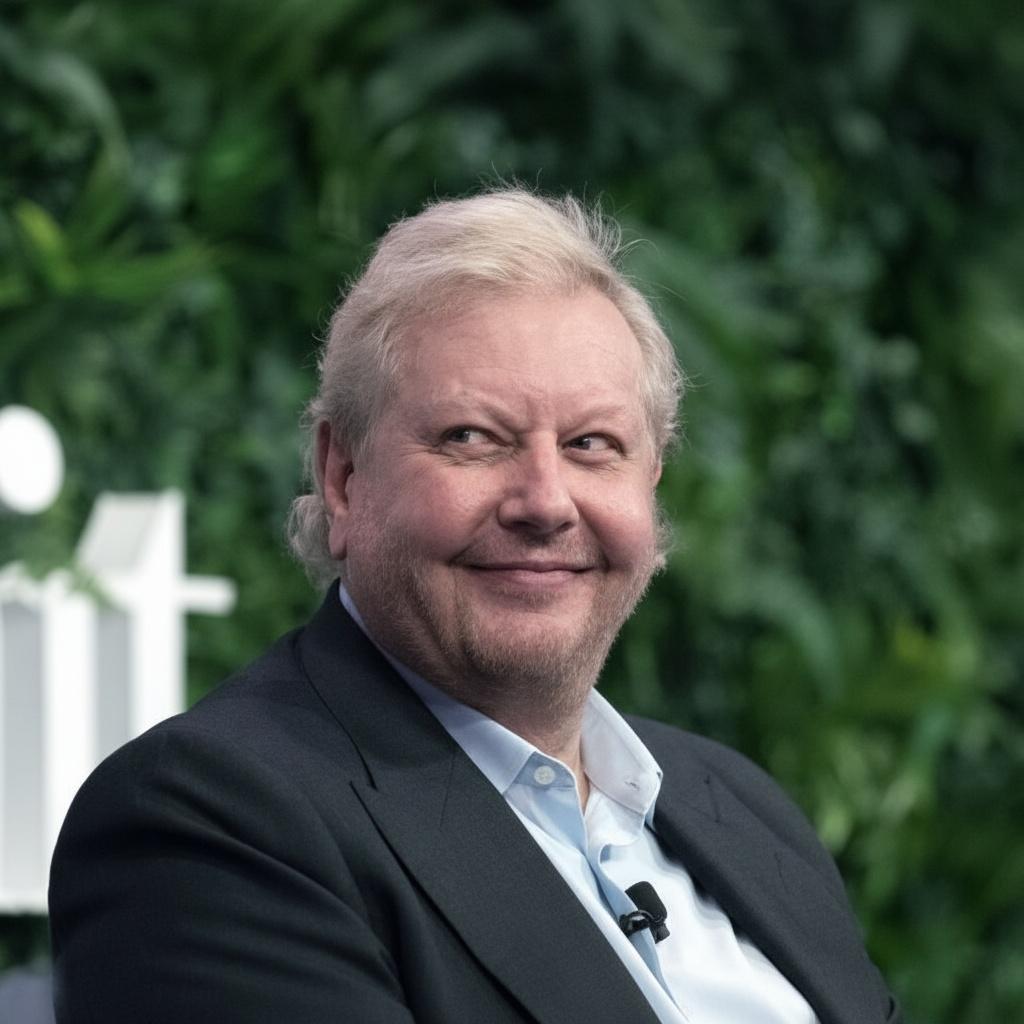

The investigation was launched amid suspicions that Richard White and some employees engaged in unauthorized trading of WiseTech shares during late 2024 and early 2025. Authorities allege that White sold over $200 million worth of shares without following the company’s internal trading protocols, including transactions during blackout periods—times when senior executives are prohibited from buying or selling stock to prevent insider trading.

Details and Allegations

According to reports, the primary concern is whether these trades violated corporate governance standards and legal regulations governing market conduct. The raid was part of a search warrant to collect documents and electronic records that could shed light on these transactions. While the investigation is ongoing, no charges have been formally filed against Richard White, the employees involved, or WiseTech as a corporate entity.

Impact on WiseTech and the Market

The news of the raid triggered an immediate reaction in the stock market, with WiseTech’s share price dropping nearly 17%, erasing roughly six months of gains and hitting a low around A$70.60. The sudden fall reflects investors’ concerns about potential governance issues and the company’s reputation amid heightened regulatory scrutiny.

Corporate Governance and Leadership Context

Richard White, a prominent business figure in Australia’s tech landscape, had stepped down as WiseTech’s CEO in 2024 due to unrelated personal matters but retained his position as executive chairman and major shareholder. The company’s board has reportedly initiated a review of its code of conduct and compliance frameworks in response to the ongoing allegations, emphasizing its commitment to transparency and lawful practices.

Broader Significance for Australian Tech

This raid marks a pivotal moment for Australian technology firms, highlighting the increasing oversight by regulators over executive behavior and share trading practices. It underlines the critical importance of adhering to strict corporate governance policies to maintain market confidence and ensure fair trading.

Conclusion

The AFP and ASIC’s raid on WiseTech’s Sydney office over alleged improper share trading exposes the challenges tech companies face in maintaining compliance amidst rapid growth and market pressures. While the investigation is still underway and no charges have been filed, the impact on WiseTech’s stock and corporate reputation has been significant. This case serves as a reminder of the crucial need for rigorous internal controls and transparent leadership in Australia’s evolving tech sector.